Indonesia's New 12% VAT Rate: Key Highlights and Implications for Taxpayers

On 31 December 2024, the Indonesian government enacted Minister of Finance Regulation No. 131/2024 (MoF 131/2024), which establishes the value-added tax (VAT) framework for the importation and sale of taxable goods, provision of taxable services, and the use of intangible goods and services from outside Indonesia within its customs territory.

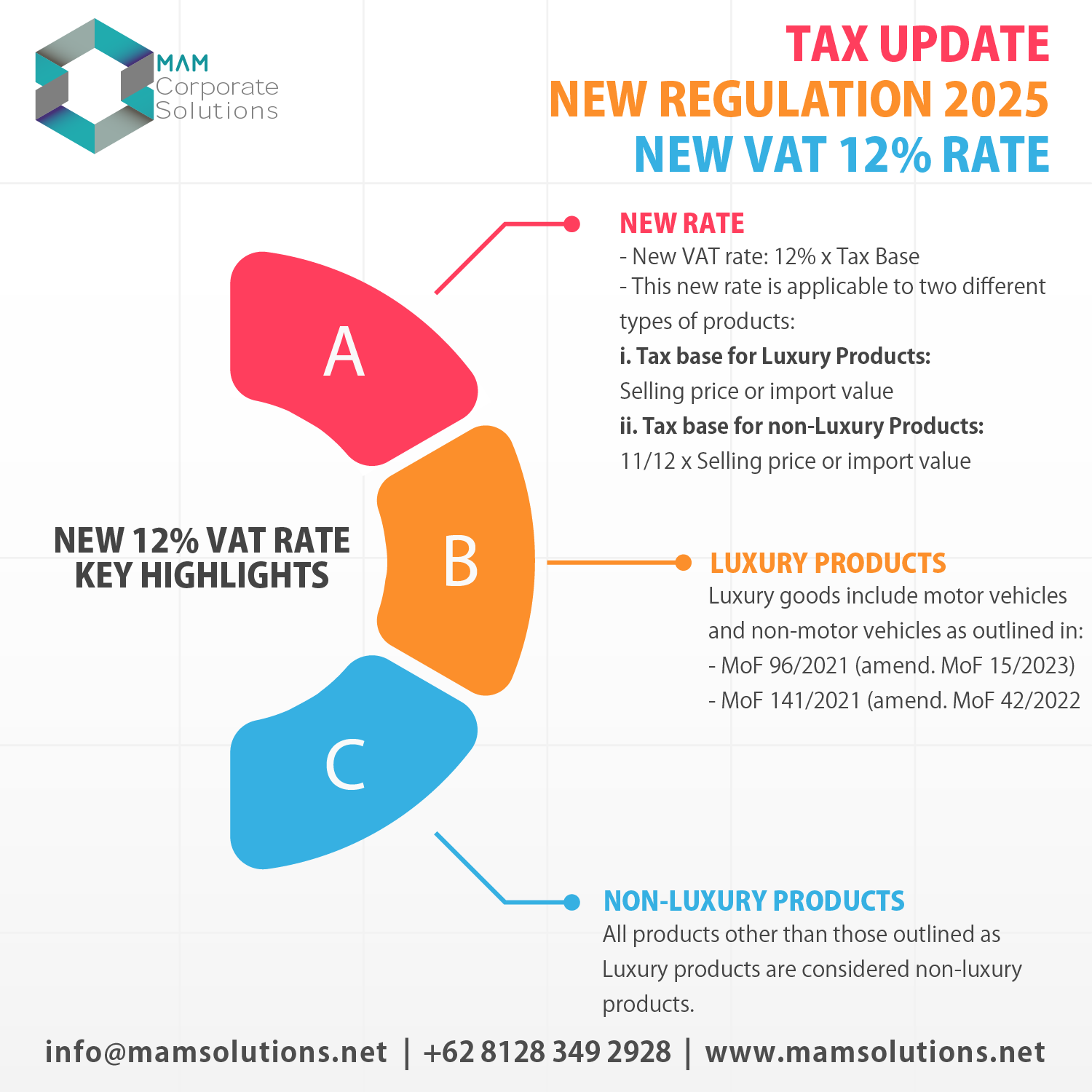

This regulation offers clarity on the implementation of the impending VAT increase to 12 percent, as stipulated under the Harmonization Tax Law No. 7/2021. The revised VAT rate will take effect no later than 1 January 2025.

Key Provisions in MoF 131/2024

|

No |

Description |

Remarks |

|

1 |

VAT Rate |

12% x Tax Base |

|

2 |

Tax Base |

Luxury Goods = Selling price or import value |

|

|

|

Non-luxury goods = Other value which is 11/12 x selling price or import value |

|

3 |

Luxury goods |

SELLING TO END USER

OTHER THAN SELLING TO END USER

|

|

4 |

Definition of luxury goods |

Luxury goods, including motor vehicles and non-motor vehicles, are subject to luxury goods sales tax, as outlined in:

|

Input Tax Credit

Businesses can claim an input tax credit for VAT paid on the acquisition or importation of taxable goods and services, as well as the use of intangible goods and services from foreign sources within Indonesia’s customs area. This is subject to compliance with prevailing tax regulations and the stipulations in MoF 131/2024.

Example Calculations for Non-Luxury Goods

To assist taxpayers in understanding the practical application of the revised VAT structure, MoF 131/2024 provides example calculations for transactions involving non-luxury goods.

This regulatory update underscores the government’s commitment to streamlining Indonesia’s VAT system and ensuring a smooth transition for businesses ahead of the upcoming 12 percent rate adjustment.

|

Year |

Selling price |

Tax base calculation |

VAT rate |

VAT payable calculations |

|

2024 |

IDR 5,000,000 |

IDR 5,000,000 |

11% |

IDR 5,000,000 x 11% = IDR 550,000 |

|

2025 |

IDR 5,000,000 |

(11/12) x IDR 5,000,000 = IDR 4,583,333 |

12% |

IDR 4,583,333 x 12% = IDR 550,000 |

How MAM Corporate Solutions can assist?

MAM Corporate Solutions offers expert guidance on tax compliance, ensuring your business meets all VAT obligations with confidence.

Contact us today by sending your enquiry or Schedule an Appointment here to discuss and learn how we can assist with your VAT compliance needs and keep your business fully compliant.

Latest insights

If you want to meet and discuss, you can easily make an appointment here.

Thanks to the efforts of the MAM Corporate Solutions team, we can now sell our products under the banner of the incorporated company. We appreciate how the MAM Corporate Solutions’ team is responsive and informative. The team’s best asset is their consistent communication.