Introduction

In the ever-evolving world of business, companies are perpetually in search of efficient ways to streamline operations and cut costs. Among the many challenges they face, payroll management stands out as a complex and time-consuming task that often diverts focus from core business functions. One strategic solution gaining widespread recognition worldwide is payroll outsourcing. This article explores the myriad advantages of outsourcing payroll and tax services to Indonesia under a new light and style.

The Strategic Value of Payroll Outsourcing in Indonesia

Payroll outsourcing is the art of entrusting payroll management tasks to an external service provider. This encompasses everything from calculating employee wages and processing payroll taxes to managing benefits and ensuring compliance with employment regulations. By delegating these responsibilities to a trusted third party, businesses can effectively free themselves from the complexities associated with payroll and tax management, allowing them to concentrate on their core competencies.

The Imperative of Payroll Outsourcing in Indonesia

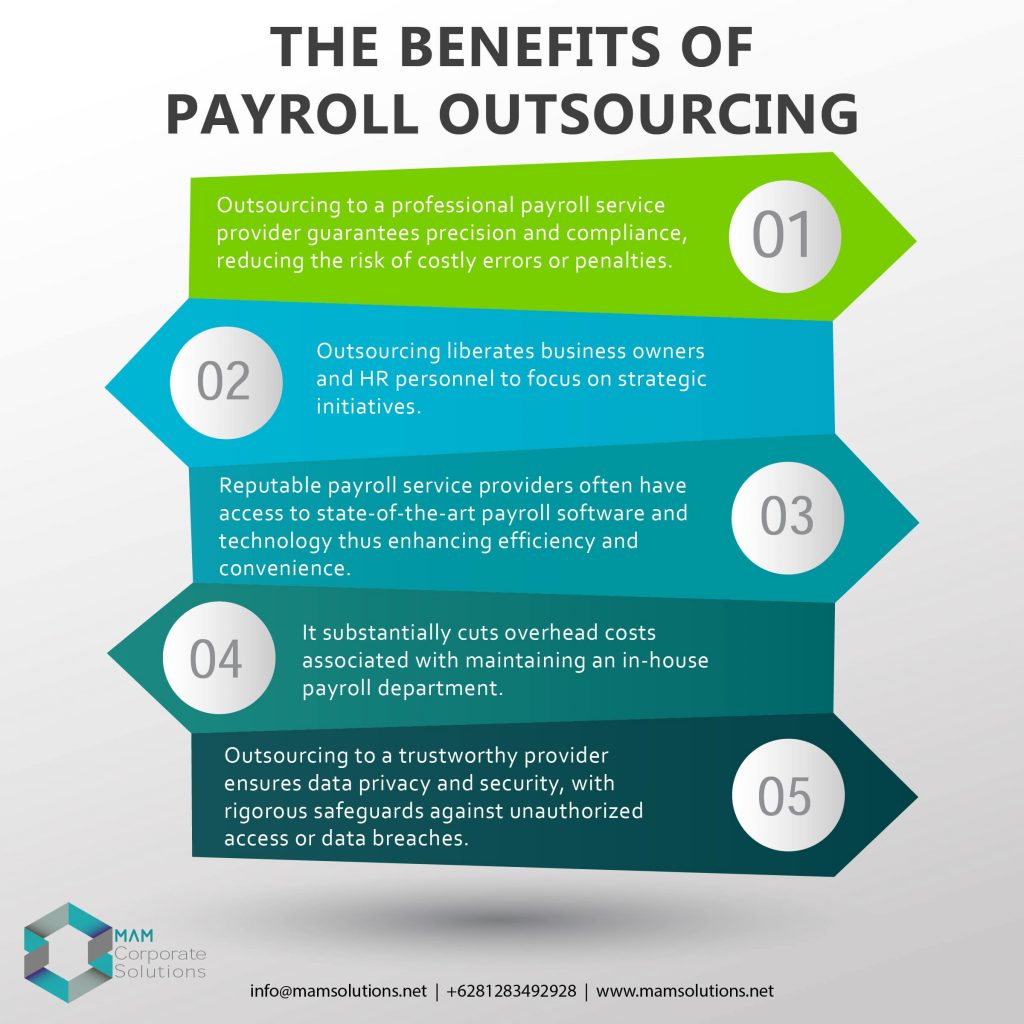

Businesses of all sizes can reap significant benefits from outsourcing their payroll services. Here are some compelling reasons behind the growing trend:

Expertise and Compliance

Payroll management requires an in-depth understanding of ever-evolving tax regulations, employment laws, and reporting requirements. Outsourcing to a professional payroll service provider guarantees precision and compliance, reducing the risk of costly errors or penalties.

Time and Cost Efficiency

Payroll processing consumes valuable time and resources. Outsourcing liberates business owners and HR personnel to focus on strategic initiatives. Moreover, it substantially cuts overhead costs associated with maintaining an in-house payroll department.

Access to Technology

Reputable payroll service providers often have access to state-of-the-art payroll & accounting software and technology platforms. This allows for seamless integration with other HR systems, precise record-keeping, and employee self-service portals, thus enhancing efficiency and convenience.

Confidentiality and Security

Payroll data is rife with sensitive information, such as employee salaries and personal details. Outsourcing to a trustworthy provider ensures data privacy and security, with rigorous safeguards against unauthorized access or data breaches.

Indonesia: An Emerging Hub for Payroll Outsourcing

Indonesia has rapidly risen as the go-to destination for businesses seeking to outsource their payroll services. Several factors contribute to this trend:

Cost-Effective Solutions

Outsourcing to Indonesia offers substantial cost advantages compared to many other countries. Lower labor costs and competitive service rates make it an attractive option for businesses looking to cut expenses without compromising quality.

Skilled Workforce

Indonesia boasts a vast pool of skilled professionals, including payroll experts, accountants, and HR specialists. Outsourcing to Indonesia ensures access to qualified experts well-versed in local payroll regulations and processes.

Language Proficiency

Proficiency in English is widespread among Indonesian professionals, facilitating smooth communication and collaboration with international clients. This ensures seamless coordination and efficient delivery of payroll services.

Time Zone Advantages

Indonesia’s time zone aligns with many Western countries, including the USA and Canada. This allows for real-time communication and faster response times, reducing delays in payroll processing and issue resolution.

Your Trusted Partner in Indonesia

To fully leverage the benefits of payroll outsourcing in Indonesia, it’s crucial to partner with a reliable and experienced service provider. One such trusted partner is MAM Corporate Solutions, a leading payroll outsourcing provider in Indonesia. With their expertise and unwavering commitment to client satisfaction, MAM Corporate Solutions offers comprehensive payroll solutions tailored to the unique requirements of businesses, ensuring accurate and timely payroll processing, tax compliance, and data security.

In Conclusion

Outsourcing payroll services to Indonesia offers an array of advantages for businesses seeking cost-effective, efficient, and compliant payroll management. With its skilled workforce, favorable cost structures, and dedication to providing top-notch service, Indonesia has emerged as the destination of choice for payroll outsourcing. By collaborating with a reputable provider like MAM Corporate Solutions, businesses can unlock the potential of outsourcing payroll services in Indonesia, allowing them to focus on driving their core business forward.

With both Payroll Outsourcing and Employer-of-Record (EOR) services, MAM Corporate Solutions takes care of the following for the client:

- Calculation of monthly salaries and relevant statutory deductions

- Monthly tax and statutory payments and filing

- Compliance with other statutory payments such as Religious Holiday Allowance (THR) in Indonesia

- Payment to employees (this is optional under payroll outsourcing)

- Keeping payroll records

- On-going advice to clients on Manpower Law updates.

Contact MAM Corporate Solutions

If you are seeking assistance with Religious Holiday Allowance (THR) in Indonesia, you can contact our expert anytime by Contacting us here or provide below as much detail about your inquiry as possible below to receive the most relevant response.

Latest insights

If you want to meet and discuss, you can easily make an appointment here.

Thanks to the efforts of the MAM Corporate Solutions team, we can now sell our products under the banner of the incorporated company. We appreciate how the MAM Corporate Solutions’ team is responsive and informative. The team’s best asset is their consistent communication.