Hiring foreign independent contractors can be risky if not done properly. Learn about various types of risks faced by foreign businesses when hiring foreign independent contractors.

As Indonesia increasingly becomes an attractive destination for businesses in today’s global economy due to its abundant natural resources and huge skilled population, more and more foreign businesses want to engage the workers from Indonesia. One obvious question asked by all foreign businesses is to whether invest in an Employer-Employee relationship or go for hiring foreign independent contractors.

At the onset, hiring foreign independent contractors in Indonesia may seem the best alternative especially for those businesses that are just expanding into the Indonesian market. This is because independent contractors are easy to engage, terminate and businesses do not have to provide office space, equipment or commit to employee benefits and allowances. However, making decisions purely on financial grounds by hiring foreign independent contractors to reduce costs can prove to be very costly for the reasons discussed in this article.

Accurately paying the independent contractors in Indonesia requires thorough knowledge of Indonesian Tax and Manpower laws which is not easy at all. Frequent changes are made to employment and tax laws in Indonesia, and if businesses are not familiar with the Indonesian work culture, public holidays, tax system and nuances of Manpower Laws then it can pose a significant risk to the businesses. Below are some of the main reasons why you should reconsider hiring foreign independent contractors as opposed to employees if you consider yourself to be risk-averse.

The risks associated with hiring foreign independent contractors

1. Risk of misclassification

It is important to understand how the Indonesian government defines an employee and an independent contractor. There are various tests that can be done to determine whether a worker is a contractor or an employee. A worker will most probably be considered an employee if:

- The worker works for a company for a long period

- The worker is reporting or taking instructions from a senior person in business

- The worker’s only source of income is from the business

- The working hours of the person are determined by the business

- The work is bound by the non-compete clause

A business may consider a worker to be an independent contractor however local government may classify it as a contractor which can lead to following risks:

a. Failure to contribute to Social Security Contributions (BPJS Health and BPJS Manpower)

Every employer in Indonesia must register all its employees for social security (BPJS) and must contribute the BPJS Health and BPJS Manpower premiums to the National Social Security Body of Indonesia. A business will certainly fail to contribute the BPJS premiums for workers that it misclassifies as contractors but classified by the government as employees. Government can impose the following administrative sanctions on such a business that does not adhere to various BPJS provisions:

- Warnings letters are issued to the business.

- Penalties are imposed if the employer fails to rectify its mistake.

- The government may suspend the business license or restrict the business from certain business activities.

b. Workers compensation issues

In Indonesia, employment law protects employees through various provisions such as entitlement to compensation payment at the end of a fixed-term contract, minimum wage, annual holidays, medical costs, work-related injuries, and other benefits. Employers are often tempted to avoid these statutory benefits and compensation payments by hiring foreign independent contractors rather than engaging the workers as employees.

However, in case of a dispute, the worker may claim these benefits and compensation payments from the employer. Courts in Indonesia favour the employment status over the contractor because Indonesian law aims to cover and protect as many workers as employees as possible. This means a business may be asked to pay such benefits or compensation payments to the workers.

2. Control over independent contracts and quality of work

With an employee, a business not only controls the nature and quality of work but also the method and way in which the work is done. Independent contractors, on the other hand, are not part of the business and they have a certain amount of autonomy. After all, that’s why they have chosen to be independent contractors over being employees because they do not like to be micromanaged.

This means that the business has limited control over various aspects of contractors such as working hours, holidays, the number of clients, focus on specific tasks or quality of the work done. Moreover, independent contractors in Indonesia may not “care” that much about the work as much as a business does because contractors do not “own” the work. This can lead to additional costs and time for the business to review the quality of the work done.

3. Risks to Intellectual Property (IP)

Hiring foreign independent contractors also means that workers are separate legal entities with specific rights in relation to their work. One of such rights is the ownership of Intellectual Property (IP) created in the course of work or project. This poses a serious risk to businesses specifically those that highly depends on technical knowledge or innovative products or services.

The creation of Intellectual Property requires heavy investments, skilled minds and time, and the last thing a business would want to have the worker claim the ownership of the Intellectual Property (IP) that is supposed to be the property of the business.

4. Contractors high turnover rate

Independent contractors are not as loyal to the business as employees. This is because employees get various benefits from the business such as allowances, job security, fixed monthly income and holidays. On the other hand, contractors are engaged for specific projects, and they can leave after the projects are complete. Since a contractor can be engaged in multiple projects with multiple businesses simultaneously there is no assurance that the same contractor will be available to the business for the next project.

High turnover of the contractors can lead to disruptions as the new contractor engaged need to go through the same learning curve. This also means more inconsistency in how the work is done.

5. Difficulty in enforcing the non-compete clause

It is easier for an employee to sign a non-compete clause that restricts the employee from working for the competitor. This is because an employee owes more loyalty to the business. On the other hand, since a contractor owns his or her own business, he or she may not be willing to sign a non-compete clause because this can prevent the contractor from signing attractive deals with other businesses including the competitors.

It may also become difficult for contractors to find new work if they are bound by the non-compete clause that they signed earlier. Even if a contractor signs a non-compete clause, it may not be enforceable in the future if it does not protect the legitimate interests of the business and causes unjustified harm to the independent contractor.

6. Permanent establishment risk

If a contractor is hired in Indonesia that is carrying out business-like activities, then it can result in corporate tax liabilities. This is known as permanent-establishment risk. This means that foreign business can be liable to the corporate income tax due to the activities of the contractor acting as its agent despite foreign business not having its own legal entity in Indonesia.

Work with an Employer-of-Record (EOR)

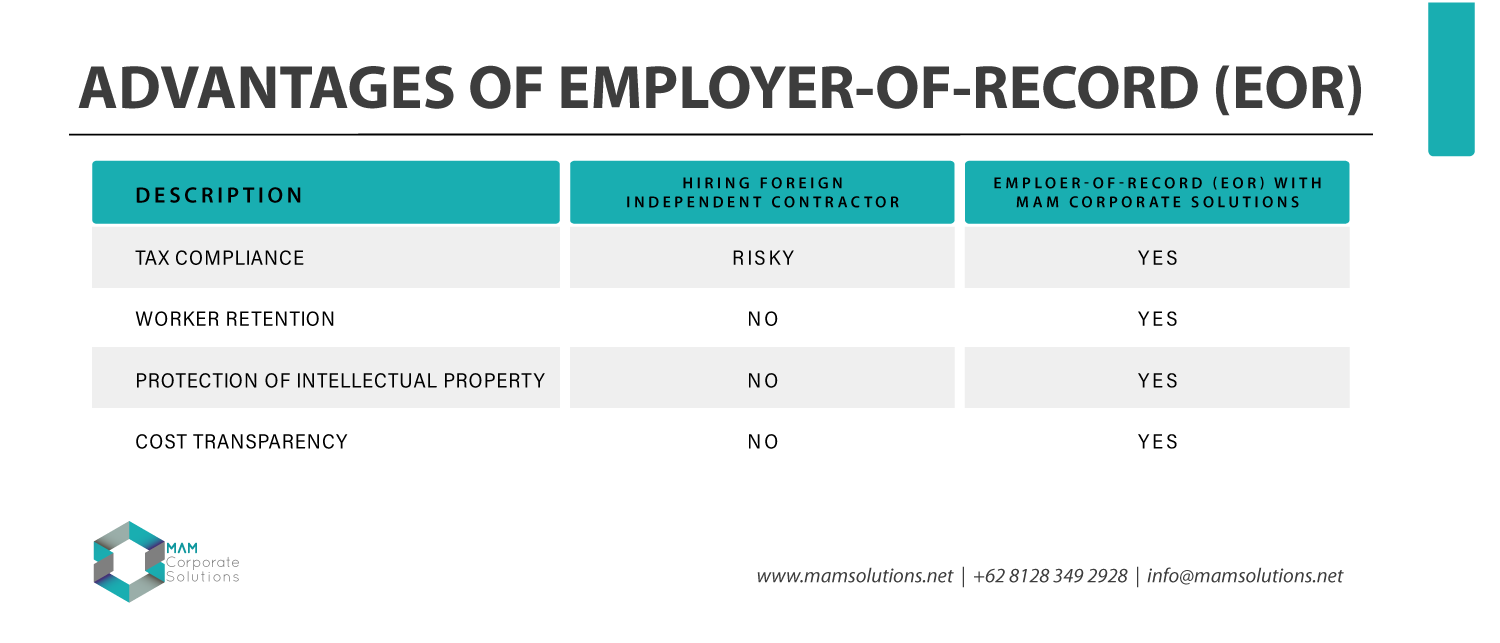

Considering the high stakes and above-mentioned risks associated with hiring foreign independent contractors, working with Employer-of-Record (EOR) in Indonesia might be the best expansion strategy. An Employer-of-Record is an organization that specializes in the Local Manpower laws and legally employs the employees on behalf of another company.

An Employer-of-Record (EOR), also sometimes referred to as International PEO, signs the employment agreement with the employee and ensures complete compliance with local tax and manpower laws while the employee works for the foreign business.

|

Hiring foreign Independent Contractors |

Employer-of-Record with MAM Corporate Solutions |

|

| Tax compliance |

Risky |

Yes |

| Worker retention |

No |

Yes |

| Protection of Intellectual Property (IP) |

No |

Yes |

| Costs transparency |

No |

Yes |

How can MAM Corporate Solutions help?

MAM Corporate Solutions provides Employer-of-Record (EOR) service to a large number of international clients from various countries including, the USA, India, Singapore, Hong Kong, and China. Instead of hiring foreign independent contractors and running the risks, engage our Employer-of-Record (EOR) service.

Our payroll, employment law and tax experts ensure full compliance from drafting the employment agreement, signing & on-boarding, monthly payroll compliance, transfer of salaries, issuance of salary slips and eventual off-boarding of the employees.

Contact MAM Corporate Solutions

If you need advice on hiring foreign independent contractors & employees in Indonesia or seek Employer-of-Record (EOR) service, you can contact our experts anytime by Clicking here or provide below as much detail about your inquiry as possible below to receive the most relevant response.

Latest insights

If you want to meet and discuss, you can easily make an appointment here.

Thanks to the efforts of the MAM Corporate Solutions team, we can now sell our products under the banner of the incorporated company. We appreciate how the MAM Corporate Solutions’ team is responsive and informative. The team’s best asset is their consistent communication.