This article provides details about Religious Holiday Allowance (THR) in Indonesia which is a 13th-month bonus salary payable to employees before the annual religious holidays.

Religious Holiday Allowance (THR) in Indonesia is the 13th month of pay. This is a practice that started in Asia and has been adopted by numerous countries all over the world. It is mandatory in certain countries such as Indonesia, Brazil, and Spain and customary in other countries such as Malaysia, Italy, and Chile.

In the Indonesian context, THR is an acronym for Tunjangan Hari Raya which means a one-month annual bonus salary given to employees at least seven days before the start of the religious holiday.

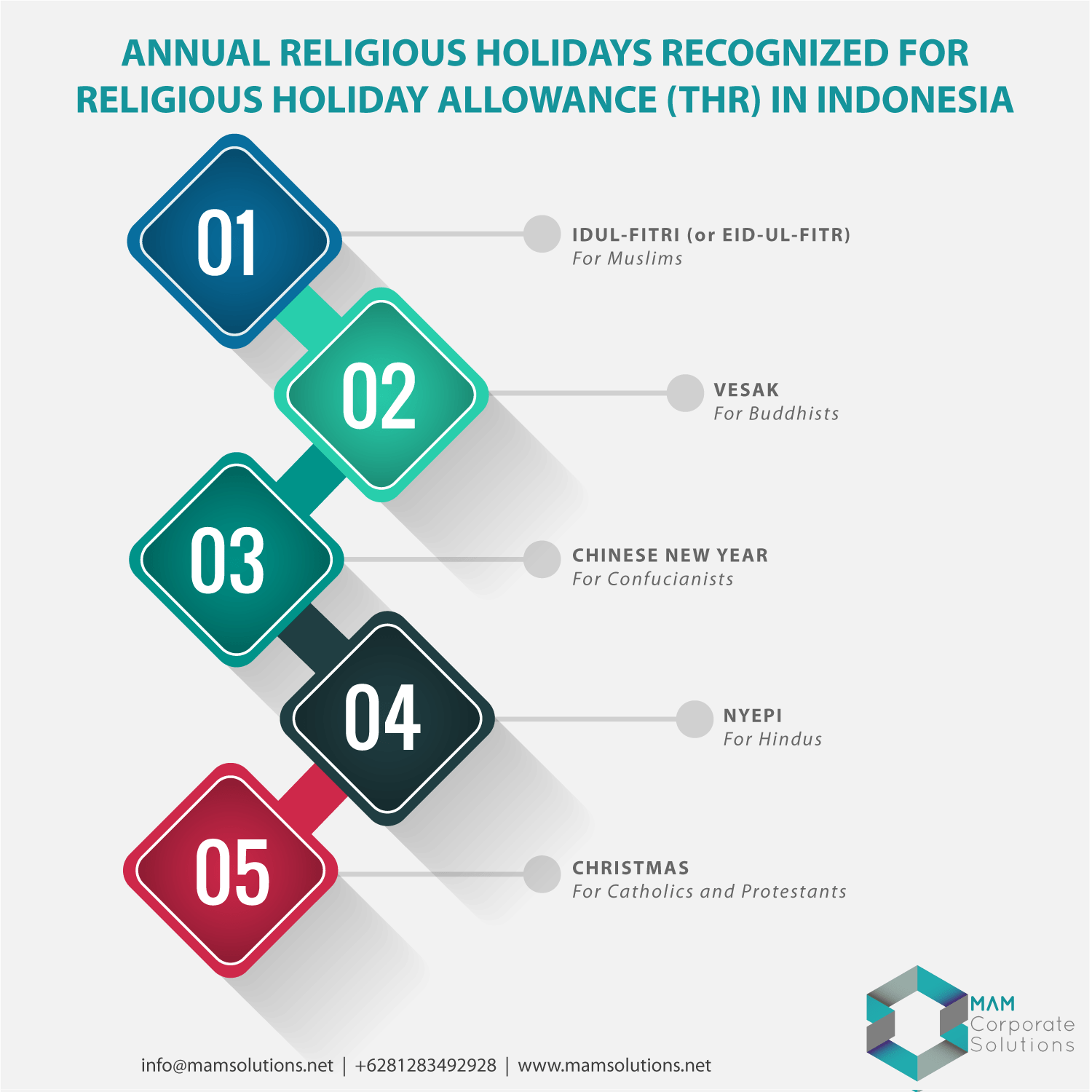

The religious holidays which are recognized for the THR payment are given below:

- Idul-ul-Fitri (or Eid-ul-Fitr) for Muslims

- Vesak for Buddhists

- Chinese New Year for Confucianists

- Nyepi for Hindus, and

- Christmas for protestant and catholic Christians

However, since Indonesia is a Muslim-majority country, most businesses pay their employees, both Muslims and Non-Muslims alike, before the annual Idul-Fitri holidays provided employees have no objection.

Frequently Asked Questions on the Religious Holiday Allowance (THR) in Indonesia

Below we have compiled a list of Frequently Asked Questions and their answers related to Religious Holiday Allowance (THR) in Indonesia.

Who is eligible for the Religious Holiday Allowance (THR) in Indonesia?

Employees who have signed an agreement for a specific period (PKWT) and indefinite period (PKWTT) are eligible for the Religious Holiday Allowance (THR) in Indonesia. Employees on PKWT and PKWTT have the right to receive THR payment if they have worked for at least one month for the company however the amount of THR payment depends on the number of months worked by the employee as explained below.

How Religious Holiday Allowance (THR) in Indonesia affects recruitment?

As mentioned above since Indonesia is a Muslim-majority country, Religious Holiday Allowance (THR) in Indonesia is usually paid by most businesses one week before Hari Raya Idul-Fitri. Hari Raya Idul-Fitri is the one of biggest annual Religious Festivals of Muslims that is celebrated right after the completion fasting month of Ramadhan. Employees are not likely to leave their jobs during Ramadan since they are waiting to receive their Religious Holiday Allowance (THR) in Indonesia. On the contrary, right after Ramadan is one of the premier times to hire new employees since they just received their THR and are excited to look for new opportunities.

What happens if employees are terminated/fired before their respective Religious Holidays?

Employees under the indefinite period contract are eligible for THR if they are laid off within 30 days of their upcoming respective religious holidays.

How is THR payment calculated?

Employees who have worked for 12 months for a company are eligible for THR equal to one month’s salary.

However, if the employee has worked for less than 12 months then THR payment is prorated based on the number of months worked by the employee as follows:

THR = Number of months worked/12 x One month’s salary.

It is also important to note that THR is based on the monthly basic salary of employees and does not include any bonuses.

Can THR be paid in the form of gifts?

No, it is not allowed to pay THR in the form of gifts. As per the Indonesian Ministry of Manpower regulation 2016, Clause 6 Religious Holiday Allowance (THR) in Indonesia must be given in a form of money.

Is THR taxable?

THR is a type of bonus and therefore it is taxable in Indonesia.

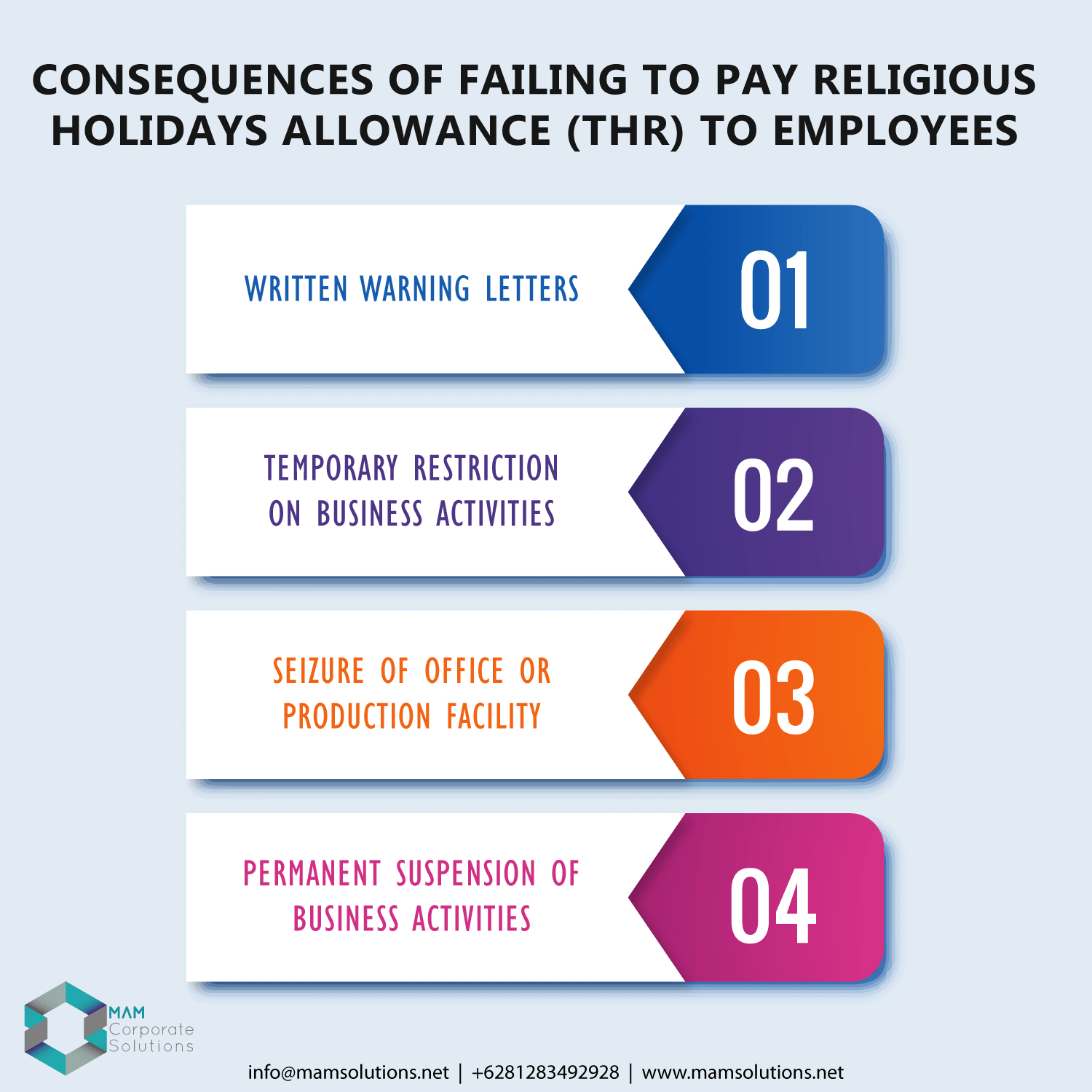

What happens if an employer does not pay THR to employees?

Employers are obliged to pay their employees Religious Holiday Allowance (THR) in Indonesia. As per Indonesian Manpower Law, an employer who fails to pay THR to its employees will be subject to a fine which is 5% of the THR amount in addition to the original THR amount payable to employees.

Failure to make THR payments to employees in Indonesia can also result in other sanctions against employers such as

- Written warning letters

- Temporary restriction on business activities

- Seizure of the office or production facility

- Permanent suspension of business activities:

What can employers do during Covid 19 pandemic?

Although many businesses are facing financial difficulty due to Covid 19 pandemic, however, the Indonesian government has advised businesses to ensure they make THR payments to employees. To make it easier for businesses that are unable to provide THR to their employees due to financial difficulty, the Indonesian government has allowed businesses to:

- Delay the payment of THR until a certain date in the future, or

- Provide THR payment to employees in parts over a period.

These two options are open to businesses if employees give their consent. Therefore, employers should discuss this matter with employees and take them into confidence before making any decision. Once a decision has been made with the consent of employees, it should take the form of a formal agreement that specifically states the dates when THR will be paid. In addition, this agreement must be reported to the Ministry of Manpower.

What are the alternative to in-house payroll function?

It is extremely important to remain compliant with Manpower laws in Indonesia because Indonesian Manpower law tends to favor and protects the employees in case of any dispute between employee and employer. One of the alternatives to having an in-house payroll function is to outsource the payroll function to an expert consulting firm such as MAM Corporate Solutions. Outsourcing payroll functions to a payroll provider such as MAM Corporate Solutions means businesses will not have to worry about payroll compliance.

MAM Corporate Solutions can assist with payroll compliance

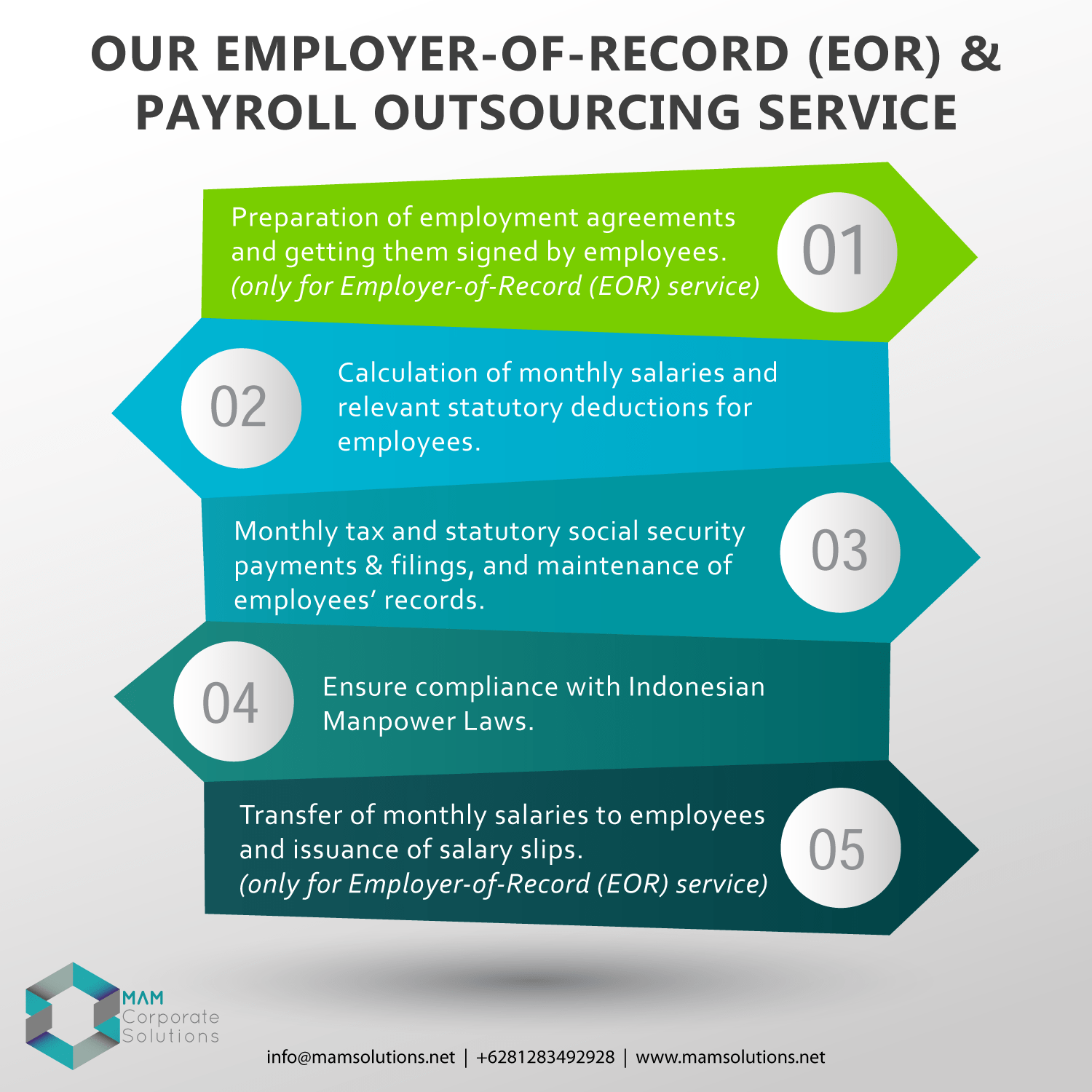

MAM Corporate Solutions has a team of payroll experts who are well-versed in Indonesian Manpower law. We offer two alternatives to businesses to ensure payroll compliance.

- Payroll outsourcing: This option is suitable for those businesses that have a legal entity in Indonesia. Employees are hired under the business however the monthly payroll function is outsourced to MAM Corporate Solutions.

- Employer-of-Record (EOR): This option is suitable for those foreign businesses that do not have a legal entity in Indonesia. With EOR service, MAM Corporate Solutions signs the employment agreement with employees and hires them, and manages the payroll compliance while employees are given work instructions from the client.

With both Payroll Outsourcing and Employer-of-Record (EOR) services, MAM Corporate Solutions takes care of the following for the client:

- Calculation of monthly salaries and relevant statutory deductions

- Monthly tax and statutory payments and filing

- Compliance with other statutory payments such as Religious Holiday Allowance (THR) in Indonesia

- Payment to employees (this is optional under payroll outsourcing)

- Keeping payroll records

- On-going advice to clients on Manpower Law updates.

Contact MAM Corporate Solutions

If you are seeking assistance with Religious Holiday Allowance (THR) in Indonesia, you can contact our expert anytime by Contacting us here or provide below as much detail about your inquiry as possible below to receive the most relevant response.

Latest insights

If you want to meet and discuss, you can easily make an appointment here.

Thanks to the efforts of the MAM Corporate Solutions team, we can now sell our products under the banner of the incorporated company. We appreciate how the MAM Corporate Solutions’ team is responsive and informative. The team’s best asset is their consistent communication.